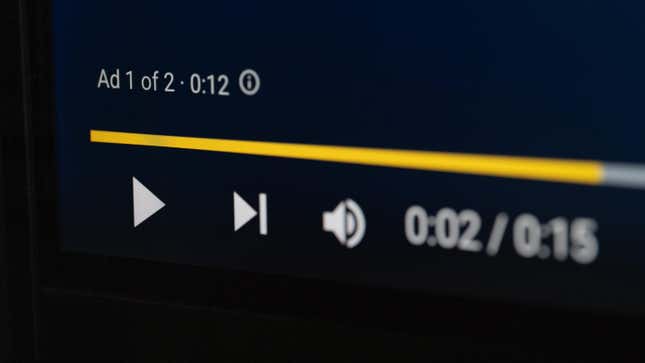

If you already hate ads on YouTube, then you’re going to have a bad time with Pause Ads. During its earnings calls on Thursday, Google crowed about the success of the tests it’s run on the ads, which could indicate the “feature” will roll out to even more watchers.

As the name implies, Pause Ads are unskippable advertisements that play when you hit pause on a video. Google is trialing Pause Ads on TVs playing YouTube videos, and according to yesterday’s call, the company is happy with the results.

“In Q1, we saw strong traction from the introduction of a Pause Ads pilot on connected TVs, a new non-interruptive ad format that appears when users pause their organic content,” Philipp Schindler, senior vice president and chief business officer at Google, said in Thursday’s earnings call. “Initial results show that Pause ads are driving strong Brand Lift results and are commanding premium pricing from advertisers.”

Schindler didn’t say if Pause Ads will roll out to more YouTube users or if these unwanted advertisements will find their way to smaller screens like phones and desktops. YouTube first highlighted the feature last year in its Upfronts post saying how these ads were a great opportunity for brands to “drive awareness or action by owning that unique interactive moment when people pause a video.”

It’s no surprise that YouTube wants people to watch more of their ads because that’s where it gets a lot of its money. That and people who pay for YouTube Premium because they’re sick of the ads.

The video platform has been cracking down on ad blockers for the past year. This move appears to be helping Google’s bottom line as the company said in its earnings call that YouTube Ads revenue was up 21% over the same time last year.